The fastest way to improve your B2B product & go-to-market: customer interviews as a service

Quickly improve key B2B marketing, sales and product assets that drive efficient Go-To-Market. With the help of ideal customers.

You now have an "Option C" cheat code to improve your buyer journeys

Option A: Trial and Error

Launch and see. Great if market acceptance is clear. But if the reception is tepid, it can be a slow, expensive way to figure out "Why?"

Option B: Run Surveys

Surveys can be hard to learn breadth and depth. Written text doesn't always capture their full emotions. Doesn't reveal what you didn't ask.

Option C: Customer Interviews as a Service

Test key assets with ideal prospects and customers. Get actionable insights early and often, reducing the likelihood of costly dead ends. Simplified to be a quick, accessible and continual service.

We interview ideal customers to get actionable feedback on your key B2B assets, usually within 4 to 5 days

We help source the right professionals that fit your ideal customers. We conduct one-on-one video customer interviews, getting deep feedback on the go-to-market assets that move your B2B. We analyze the results and suggest next best actions.

Move faster when you uncover what really moves your ideal customers

Your cheat code. Test key assets, messaging and experiences with your best customers and new-to-you ideal prospects. Move faster and cheaper than your competitors' trial and error process. Discover the most valuable version of your product for your most valuable customers. And how best to communicate it.

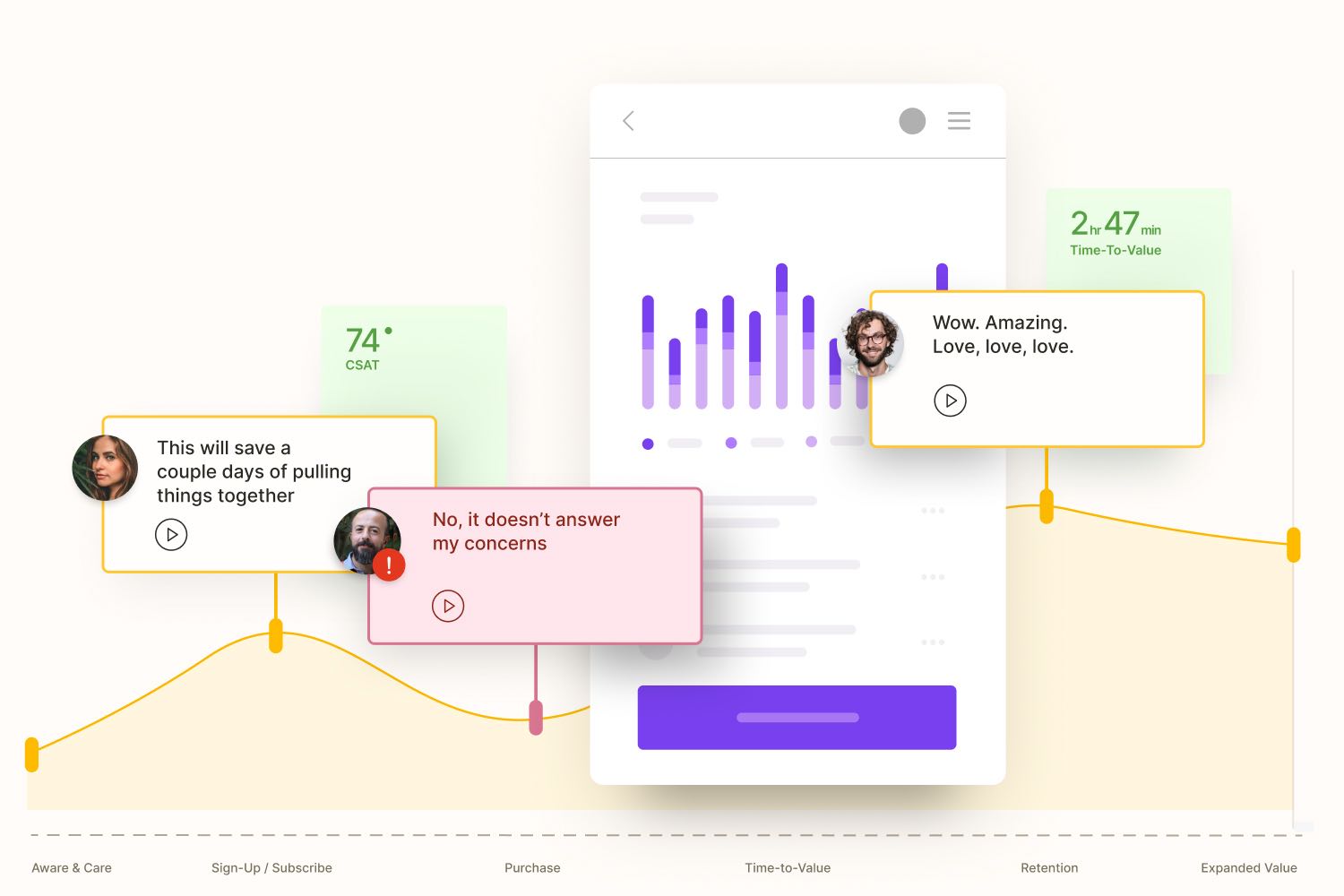

Deliver greater value all along the buyer journey

Uncover how to improve each key step of your buyer and customer journeys. Built on deeper insights, build better performing assets for your most pivotal marketing, sales and product experiences.

Where does your buyer journey need the most improvement?

Launch a product people are excited about

Build more demand within the market

Capture more quality leads

Close more quality deals

Onboard new customers more successfully

Retain and renew more existing customers

Expand more sales among existing customers

Increase referrals

Understand our best customers better

Understand a new market better

Who do you want to

resonate with more?

Our Best Customers

Buyers

Buyers In a New Market

Won/Lost Buyers

Renewal Customers

Churned Customers

Improve the assets that drive your B2B

The best way to test unknowns like those above is via concrete assets. Uncover answers to hard questions via ideal customers' feedback on prototype, draft or launched versions of your most important assets:

- Product Assets:

- Onboarding Process

- Core Product Function

- New Product Feature

- Web Assets:

- Product Page

- Landing Page

- Pricing Page

- Video Sales Letter

- Sales Assets:

- Sales Deck

- Proposal Template

- Sales Funnel

- Video Assets:

- Explainer Video

- Video Sales Letter

- Video Ads

- Webinar Video

- Content Assets:

- Lead Magnet

- Explainer Video

- Content Video

- Guide

- Advertisement Assets:

- Text & Image Ads

- Video Ads

- Customer Success Assets:

- Onboarding Assets

- QBR Assets

- Educational Content

Need a hand creating drafts of the assets above? We can help.

We work with B2B SaaS leaders who want to move quickly

F

B2B Founders & CEOs

Get validation for your hunches. Uncover opportunities and reduce risks when entering new markets or positioning within an existing one.

M

B2B CMOs & Marketing Leaders

Test positioning and messaging for product launches, marketing campaigns, landing pages, sales assets, ads and lead magnets. Refine go-to-market strategies and improve lead generation and conversions.

S

B2B CROs & Sales Leaders

Get feedback from won/lost buyers, renewal and new market customers. Get candid, unguarded feedback when prospects and customers are in the research context. Optimize sales decks, proposals, and positioning to better connect with prospects and close high-quality deals faster.

P

B2B CPOs & Product Leaders

Gather insights from your best —as well as your churned— customers along with new market customers. Get feedback on product features and positioning to align development with customer needs and market expectations.

RS

B2B Researchers

Add additional qualitative data with less effort. We help you uncover customer motivations, pain points and feedback on assets to complement your qual and quant data from other sources.

Start improving your B2B buyer journeys via customer interviews

What builders are saying

"Really effective process that's capital efficient. You've clearly crafted the service to meet the needs of startups, with the right balance of research, polish, cost and speed."

"The sprints we ran with Sunny were breakthroughs for us. Our team was able to focus on core challenges via a systematic approach that compressed a lot of decision making into a short period of time. One result was the doubling of our signup conversion rate. Another was a completely new way to sponsor conversations that are core to our site's growth."

"Synthesizing a high volume of information and working with clients to turn it into the most meaningful actions is challenging. Great work!"

"Some of the best I've ever seen at getting up to speed and representing the ideals and solutions accurately... Ensures we have the information needed to get the answers to the questions that need to be answered to drive value for the customer."

"It focused us and forced us to align on what is important to our company and our app vs getting caught up in trivial requirement conversations. It helped having their expertise to keep us moving in the right direction... They do an awesome job but also have great creative ideas and design chops that we're lucky to have access to. Thank you!"

"Easy to work with, thorough investigation, knowledge in marketing and business, and vast knowledge in modern tech platforms and techniques."

Frequently asked questions

Why Improve Go-To-Market with Sunny

"Option C" focuses on direct customer interviews to gather real feedback on assets, avoiding the costly guesswork of trial and error and the limited insights of surveys.

Customer interviews provide deep, qualitative insights that go beyond metrics or survey responses. By engaging one-on-one with your ideal prospects or customers, you can uncover more of their motivations, pain points, and reactions to your topic and assets. Unlike surveys, interviews allow for follow-up questions and exploration of unexpected insights, giving you a richer understanding of what drives buying decisions.

This method can be a fast way to build assets and strategies that resonate, reducing the risk of misalignment, wasted resources and lengthy dead ends.

Interviews are typically scheduled, conducted and analysis delivered within 4 to 5 business days after requests for respondents go out. Reaching new respondents for very niche target markets and other factors may delay this timeframe.

Gain feedback on the market (such as "how CROs buy CRMs"), your specific best customers (such as why they chose your product), as well as reactions to your assets. You may uncover what excites them, what confuses them, their objections and see patterns emerge.

We hold 1-on-1 video interviews with ideal prospects or customers, sourced by either you or us, asking for their feedback on a topic (example: how they buy CRMs) and presenting an asset for review. Calls are recorded with consent.

Yes! We'll source and schedule interviews, and you can conduct the interviews. We'll provide suggestions for the interview structure and questions to ask.

Go-To-Market Assets To Test

Get feedback from ideal prospects and customers about your biggest unknowns. Get detailed responses on your product ideas, positioning and messaging. Test via marketing and sales assets like product webpages, landing pages, sales decks, proposal templates, ads, and lead magnets—whether they are drafts, prototypes or live.

Yes! You can provide a short brief along with a text outline, sketch or draft of the asset, and we will create a draft asset to test. Tested assets will be yours to refine further for production if you like.

Definitely! We can test the positioning and value propositions of the product-to-be via marketing or sales assets such as a product webpage prototype or a sales deck prototype. We can also test via a clickable product prototype.

Absolutely! We can include questions about pricing perceptions to help gauge if your target customers see value at specific price points. A product page with pricing plans could be a great asset to test.

Yes! Iterations and continual refinement is a great use of the service. You can schedule follow-up interviews to gather feedback on updated versions of your assets to gauge improvement.

Yes, we can include competitor comparisons in the interviews to understand how your positioning stacks up in the market.

Interviewees

The choice is yours. We'll discuss your options, but here's a quick take. When you want feedback from your best customers who know your product well, your customers are the best option. When you want to test the market's reaction to your product similarly to how new prospects do, we can source interviewees.

We'll discuss your options based on your resources, but here are common sources: 1) Your best customers, 2) prospects such as subscribers to your newsletter, and 3) qualified people within your teams' personal networks.

We source U.S. professionals based on role, company type, and relevance to your product. We perform a vetting process and let you choose from a shortlist of candidates. Professionals who take part in interviews are incentivized for their time.

We review respondents and their employers, including LinkedIn profiles and other public sources. You have the final say on who to invite to interview from the shortlist we provide.

Absolutely! This is key. We can focus on specific roles and employer characteristics like company size and industry based on your target market to ensure the feedback is relevant and actionable. Certain niche segments may be harder to source and we'll discuss options before proceeding.

Our primary focus is currently on U.S.-based professionals. Please contact us if you'd like to discuss other regions.

Insights

Gain feedback on the market (such as "how CROs buy CRMs"), your specific best customers (such as why they chose your product), as well as reactions to your assets. You may uncover what excites them, what confuses them, their objections and see patterns emerge.

Yes, we offer a concise report with key themes, actionable insights, and recommendations based on the interview findings. You will also be able to view the original interviews and provide your own analysis as well.

Yes, we can include competitor comparisons in the interviews to understand how your positioning stacks up in the market.

Other Questions

We'll help you find the mix that works for you. As an example, you can start with 5 interviews for an asset to gain initial insights. If you find value, you can continue with a monthly plan tailored to the number of assets and interviews you need.

Early-stage and mature SaaS companies, especially those launching new products and refining existing ones for better performance.

We handle sourcing, vetting, scheduling, interviewing, and analysis. You receive raw interview footage and actionable insights to move forward.

We obtain consent from all participants, use secure video platforms, and follow data privacy guidelines to protect your information and that of the respondents.

Plans start at $1800 a month. You can try a month and see if it works for you. Submit the "Get Started" form to start the conversation.

Click "Get Started" on this, or any, page. Fill out a bit of info about what you need and any questions you may have and submit to start the conversation.

We offer email and phone support.

Start improving your B2B buyer journeys via customer interviews

About

We believe talking to more customers is the gold standard in helping improve key go-to-market experiences quickly. But talking to more customers needs to be easier. Sunny Customer Experiences handles the messy parts of B2B customer interviews so you can focus on the most important thing: acting on the insights that improve your go-to-market.